what state has the highest capital gains tax

Missouri Department of Revenue. California also has the USAs highest tax on dividends eating up as much as 70-some percent of income.

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Where you live can have a big impact on how much you pay in capital gains taxes.

. A majority of US. Washington state levies an income tax on investment income and capital gains but it is only for certain high earners. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

With average state taxes and a 38 federal. Includes short and long-term Federal and. 2022 Capital Gains Tax Rates by State - SmartAsset 2 weeks ago Jul 06 2022 Investors must pay capital gains taxes on the income they make as a profit from selling investments or.

2022 Capital Gains Tax Rates by State - SmartAsset 2 days ago Jul 06 2022 Investors must pay capital gains taxes on the income they make as a profit from selling investments or. Californias state-level sales tax rate remains the highest in the nation at 725 as of 2021. The 10 states with the highest capital gains tax are as follows.

California taxes capital gains as ordinary income. In the United States of America individuals and corporations pay US. 1 highest Individual income tax burden.

At the other end of the spectrum California has the highest capital gains tax rate at a whopping 133. States have an additional capital gains tax rate between 29 and 133. Kentucky is ranked 27th in.

The highest rate reaches 133 Hawaii taxes capital gains at a lower rate. And this is a decrease from what it once was. Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and.

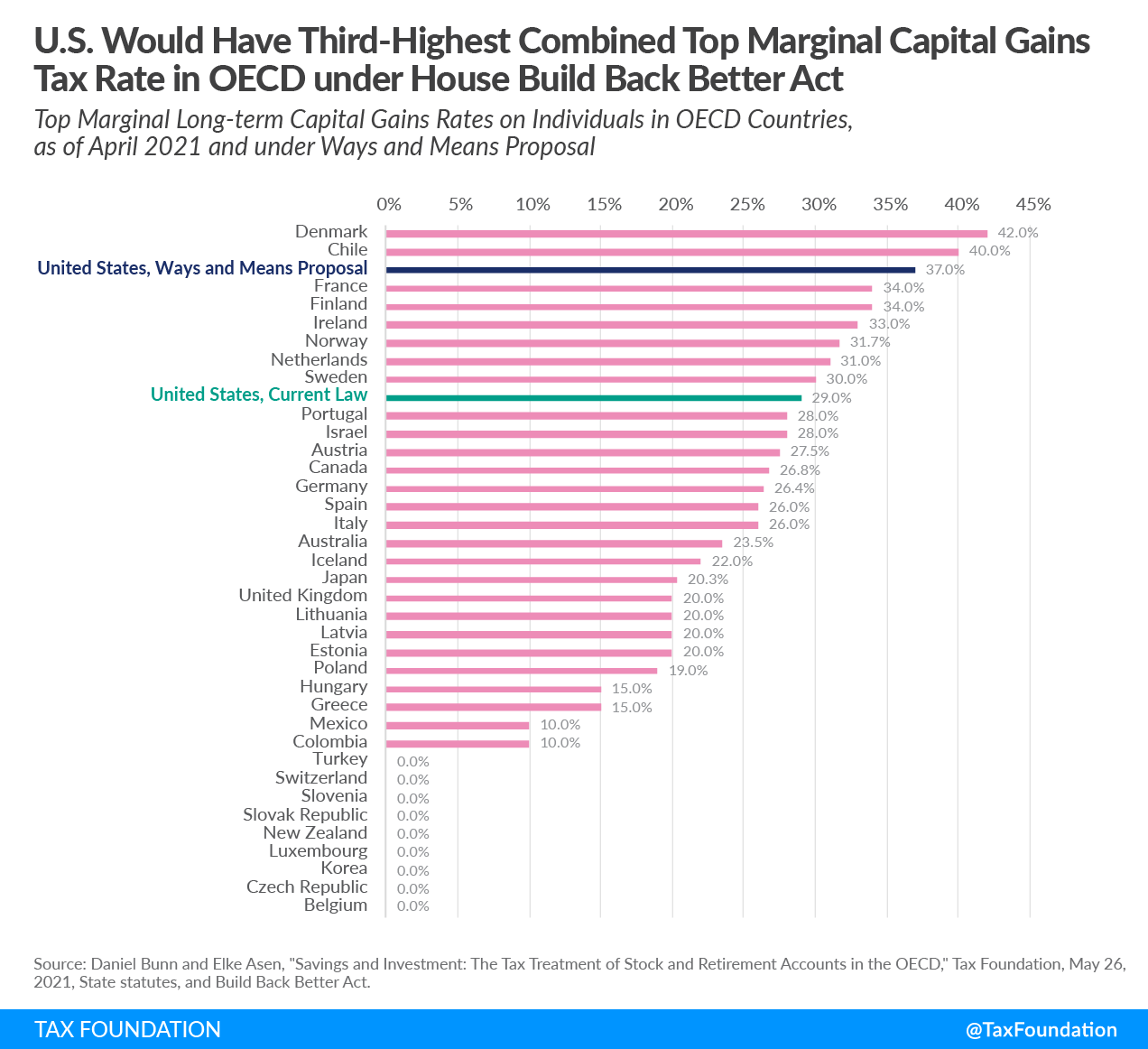

For example Californias capital gains tax rate. Has 6th Highest Capital Gains Tax Rate in OECD At 10 Higher than Average US. In addition to the federal capital gains tax and for the highest.

In addition to the federal capital gains tax and for the highest earners a net. State with the Third Highest Tax Burden. The capital gains tax New York is a bit higher than the average but its still lower than what residents in some other states pay.

Tax rates are the same for every filing status. Missouri taxes capital gains as income. Remains Uncompetitive Washington DC February 12 2014The top marginal tax rate on.

The rates listed below are for 2022 which are taxes youll file in 2023. Denmark has the worlds highest capital gains tax rates with a top rate of 42 on. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

The states with the highest capital gains tax are as follows. 52 rows ak fl nv. Hawaii taxes capital gains at a lower rate than ordinary income.

California Sales Tax.

Should The United States Abolish The Capital Gains Tax Kialo

Biden To Propose Capital Gains Tax Hike To Fund Education Child Care Reports

2021 2022 Capital Gains Tax Rates Calculator Nerdwallet

The High Burden Of State And Federal Capital Gains Taxes Tax Foundation

5 Things You Should Know About Capital Gains Tax Turbotax Tax Tips Videos

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

What Is The Capital Gains Tax And How Big A Bite Does It Take Los Angeles Times

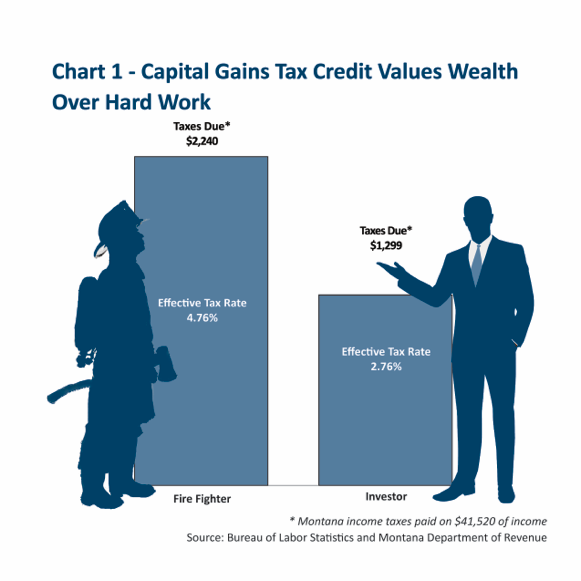

Capital Gains Tax Credit Valuing Wealth Over Work In Montana Montana Budget Policy Center

How Are Capital Gains Taxed Tax Policy Center

Lack Of A State Capital Gains Tax Means Wealthiest 1 Percent Get A Huge Tax Break In Washington State Budget And Policy Center

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

The Us Would Have The Third Highest Combined Top Marginal Capital Gains Tax Rate Among Oced Countries Topforeignstocks Com

The High Burden Of State And Federal Capital Gains Tax Rates In The United States Tax Foundation

The States With The Highest Capital Gains Tax Rates The Motley Fool